You’re a careful driver with no accidents or traffic infractions on your record, so why has the cost of your car insurance gone up? You’re not the only one trying to figure out why car insurance premiums get more expensive.

This article from the Tampa personal injury lawyers at KFB Law removes some of the mystery that has drivers all over the country scratching their heads, wondering why they must pay so much to insure a car. It gives you a peek behind the curtain at the factors insurance companies use to set car insurance rates. Number 4 on the list is guaranteed to surprise you.

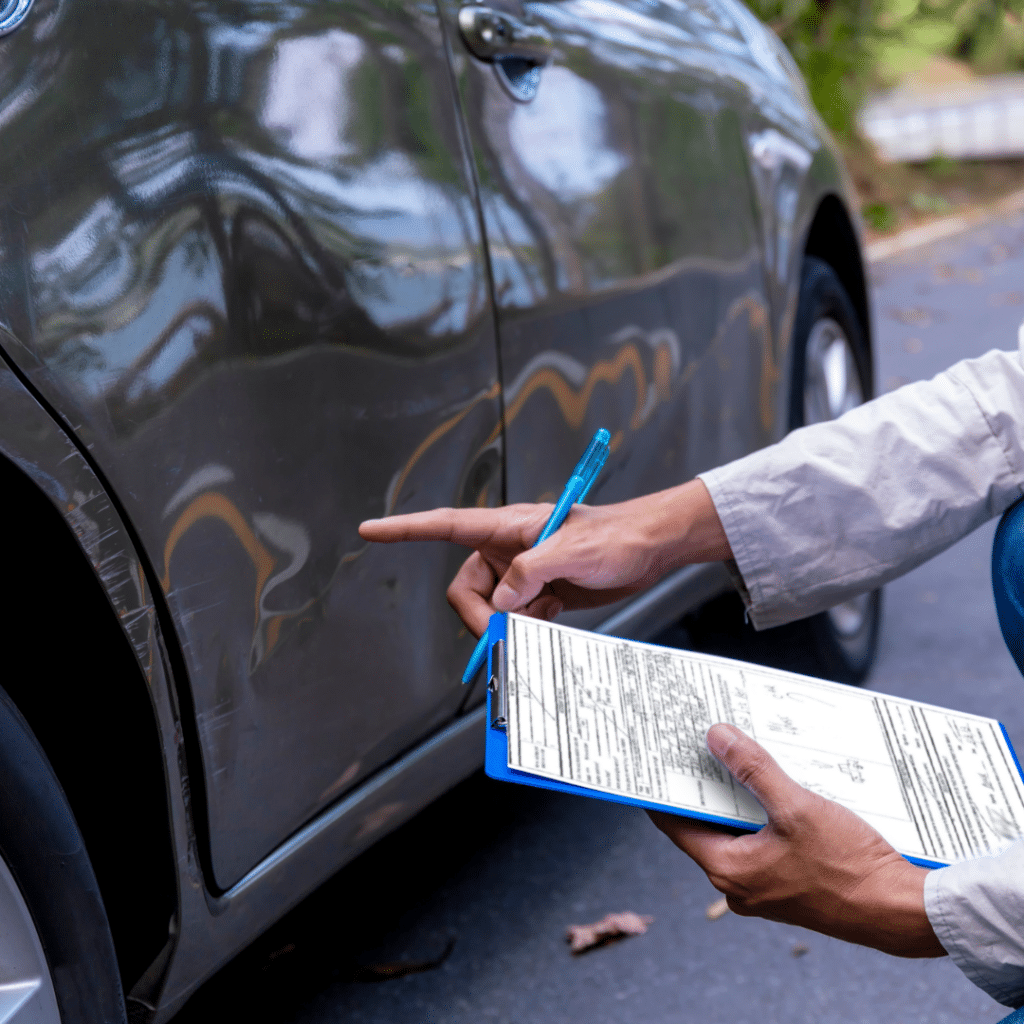

Reason 1: A driving record with moving violations or accidents

Driving while impaired, speeding, and other violations of state traffic laws cause your insurance rates to increase. Insurance companies use traffic violations to indicate the likelihood that you may cause an accident resulting in an insurance claim.

Accidents can increase your insurance premiums, but Florida law protects you unless the accident was substantially your fault. For example, if you are legally parked and another driver crashes into your car, the company insuring your car cannot increase the cost of your car insurance because you are not substantially at fault.

However, if you parked with a section of your car extending into the traffic lane, your insurer may determine that the way you parked made you substantially at fault. This could cause your insurer to increase the cost of your car insurance when renewal time rolls around.

Reason 2: Young or inexperienced driver in the household

Teenage drivers in Florida between the ages of 18 and 19 have the highest crash rates of any other age group. The age is slightly lower nationally, where 16 and 17-year-old drivers exceed all other age groups in their crash rates. Car insurance companies charge more for automobile insurance when a young driver lives in the household.

Driver inexperience prevents young motorists from recognizing and reacting appropriately and safely to dangerous situations. Studies show that teenagers are more likely to engage in risky behaviors, such as speeding, tailgating, and driving while impaired than older motorists.

Reason 3: You moved or bought a new car

Where you reside can affect how much you spend on car insurance. Insurers routinely look at the following factors related to where you live when determining the cost of car insurance:

- Crime rates where you moved.

- Accidents in the community where you live.

- Incidents of insurance fraud.

- Hurricanes, tornados, or other natural disasters may cause car damage.

- Number of uninsured and underinsured motorists.

Another factor that may affect how much you pay for car insurance is purchasing a new car. You see a bright, shiny vehicle equipped with every bell and whistle. Your insurance carrier sees an expensive claim to replace or repair it when it’s stolen or damaged in a crash.

Reason 4: Low credit score

Auto insurance companies rely on research to guide decisions about insurance rates. Someone financially responsible and with a higher credit score is less likely, at least according to insurance companies, to file claims.

Whether credit scores are an accurate indicator that a person is likely to file an insurance claim may not be based on science, but insurance companies continue to use it to set rates except in a few states that have laws prohibiting the practice. If you live in Florida, your car insurance company may use your credit history to determine how much to charge.

Florida law requires insurance companies to inform you when a credit score or credit report is requested in connection with an application or renewal of a car insurance policy. If an insurer decides to increase your rate, refuse to renew, or take other adverse action, it must notify you of the reasons and how the credit score or report affected the decision.

Reason 5: An increase in annual mileage driven

It’s hard to argue with the logic used by car insurance companies that says a car driven 30,000 miles a year is more likely to be in a crash than one driven only 2,500 miles. The good news is that you can make annual mileage work in your favor.

If your annual mileage driven goes down rather than up, let your insurance company know. You may see a decrease in how much the company charges.

Contact KFB Law Today

If you sustain injuries in a car accident, your first call should be to Kinney, Fernandez, & Boire. Contact us today for a free consultation to learn about your right to compensation and what a personal injury attorney can do for you.