Tampa Insurance Disputes Attorney

Let us handle the insurance, paperwork, and your rights—while you recover. We fight for your rights with insurance companies while you recover.

Attorneys standing by and ready to help

Every lawyer I went to told me I didn’t have a case at all and that there is nothing that they can do. KFB LAW works miracles and will never disappoint their clients. KFB LAW is the best. Call! Don’t hesitate at all. They are the best.

Kings Made

Car Accident

38

years of insurance disputes law experience

Dedicated Tampa Insurance Attorney

Insurance companies spend more than $6 billion a year to attract customers willing to pay premiums for the protection offered by an insurance policy. The friendly, reassuring tone of most of the advertising portrays the relationship between you and your insurance company as a partnership with the company poised to pay your claim.

The reality, in many cases, is that an insurance claim creates an adversarial situation in which the company seeks to limit what it pays out. When disputes arise between you and an insurance company over a claim or coverage, you need an experienced Tampa insurance attorney from KFB Law committed to fighting for the benefits your premiums entitle you to receive.

The reality, in many cases, is that an insurance claim creates an adversarial situation in which the company seeks to limit what it pays out. When disputes arise between you and an insurance company over a claim or coverage, you need an experienced Tampa insurance attorney from KFB Law committed to fighting for the benefits your premiums entitle you to receive.

What is an insurance dispute?

Disputes between policyholders and their insurance companies usually relate to a claim filed by the insured. Common disputes associated with medical, motor vehicle or home insurance policies include:

Insurance policies are contracts between you, as the insured, and the company issuing the policy. As long as you pay the premiums, the insurance company agrees to provide benefits according to the written terms of the policy. When a company violates the provisions in the policy it issued to you, a Tampa insurance dispute lawyer can provide trusted, knowledgeable legal advice and skilled representation.

Types of Insurance Claims

Our insurance dispute attorneys are experienced in a variety of insurance dispute claims including:

Auto Insurance Claims

After an accident, settling your claim quickly might seem like the most comfortable alternative. Before you sign a settlement agreement, it’s important to consult with an attorney. They can help determine if your policy terms are being met and file important complaint documents within the deadline.

Homeowners Insurance Claims

If you or a loved one suffers an injury at your home or property, you may need to file a claim against your homeowner’s insurance. Our team will help quickly evaluate your case and file a claim to ensure that you are getting any medical treatment needed.

Life Insurance Claims

The loss of a loved one can devastate a family both personally and financially. When an insurance company adds to the anguish by denying a life insurance claim, an insurance dispute attorney can help. Our attorneys have stood up to life insurance claim denials and helped clients get the benefits that they deserve.

Florida law prohibits unfair claims practices

When your insurance company refuses to pay a claim or engages in tactics designed to delay payment of a claim, it could be violating Florida law. If your claim is for injuries or property damage related to an automobile accident, the insurance company must investigate the claim in a timely fashion and notify of its decision within 30 days from the date it receives your claim. If it denies payment of the claim, it must give provide a written explanation for the denial.

The following are some of the other claims practices insurance companies are prohibited from engaging in under Florida law:

When your insurance company denies your claim for benefits, you have the right to dispute the company’s decision.

Disputing an insurance company decision in Florida

If you receive an adverse decision from an insurance company handling a claim, you have the right to file a complaint with the Florida Department of Financial Services. The insurance company then has 20 days to submit its response to the department. You could receive a decision from the FDFS as quickly as 30 days after filing your initial complaint.

When taking on a powerful insurance company through the FDFS complaint process, you need legal representation by a competent Tampa insurance dispute attorney. An attorney who knows and understands state insurance laws uses that knowledge to focus on policy provisions and legal principles supporting your position.

When taking on a powerful insurance company through the FDFS complaint process, you need legal representation by a competent Tampa insurance dispute attorney. An attorney who knows and understands state insurance laws uses that knowledge to focus on policy provisions and legal principles supporting your position.

When to take your insurance dispute to court

An aLitigation against your insurance company is an option when other methods fail to achieve a resolution that is in your favor. This could be the case if your insurance carrier acts in bad faith.

For instance, if you someone sues you claiming to have suffered injuries in a motor vehicle accident and the evidence supports a finding that you were at fault, your insurance company must act in good faith to settle the claim. The failure of your insurance company to settle the claim within the limits of the policy knowing you could be personally liable if a trial results in a verdict in excess of the policy amount could be bad faith.

For instance, if you someone sues you claiming to have suffered injuries in a motor vehicle accident and the evidence supports a finding that you were at fault, your insurance company must act in good faith to settle the claim. The failure of your insurance company to settle the claim within the limits of the policy knowing you could be personally liable if a trial results in a verdict in excess of the policy amount could be bad faith.

Disputing an insurance company decision in Florida

An aggressive and experienced insurance dispute attorney might resolve a dispute through negotiations directly with the insurance company before it becomes necessary to file a complaint or resort to litigation through the courts. Depending upon your particular situation, your attorney might recommend alternative dispute resolution procedures.

State law in Florida provides for mediation as a method of resolving insurance disputes. For example, a dispute about a claim you submitted under your homeowner insurance policy may be submitted to mediation by your insurance attorney.

State law in Florida provides for mediation as a method of resolving insurance disputes. For example, a dispute about a claim you submitted under your homeowner insurance policy may be submitted to mediation by your insurance attorney.

Obligations your insurance company has to you

In many respects, an insurance policy is a basic contract no different than any other contract such as a contract to buy a car, a real estate contract, or an employment contract. All contracts have terms and conditions, which spell out what either side of the contract has to do, what they have to provide, and how they have to behave with respect to the other party in the contract. These are the basic rules by which the parties of the contract must abide. The terms and conditions also contain the benefits that are provided by the contract. For example, a benefit that may be available under an insurance contract (the policy) could include payment for medical expenses or property damage.

In some cases, insurance polices and the laws of our state allow for an insured party (you) to get your attorney’s fees and costs paid by the insurance company if you prevail in a lawsuit. In other disputes there are no automatic provisions for payment of attorney’s fees or costs.

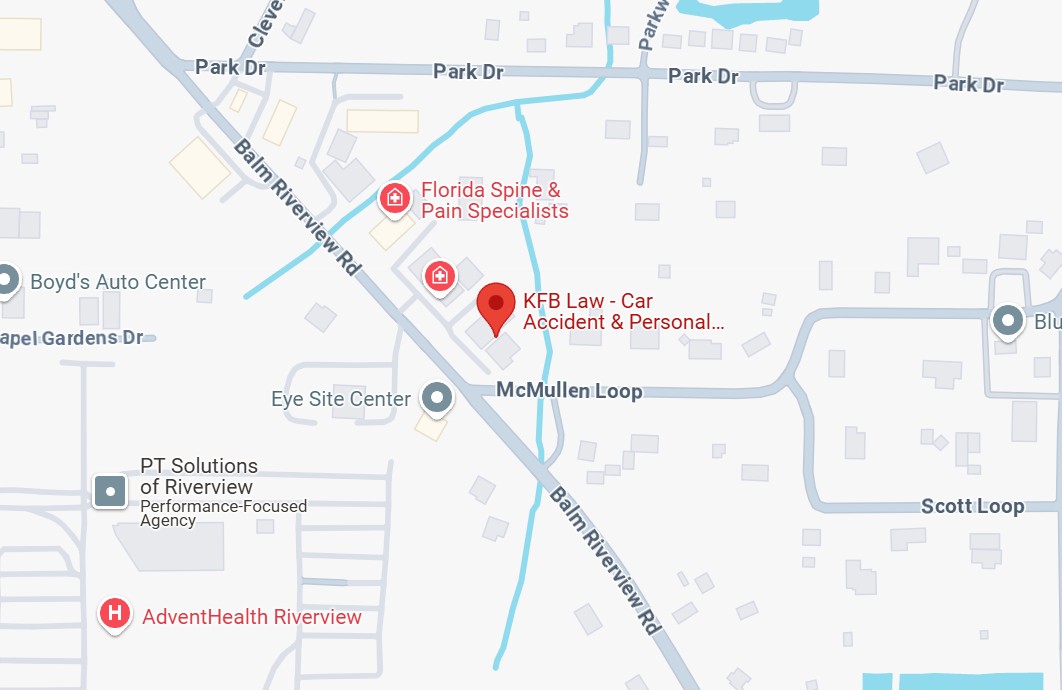

6 Offices Across Tampa and Surrounding Areas

We make it convenient for you to meet with us. Select the location closest to you.

Tampa

St. Petersburg

Plant City

Wesley Chapel

New Port Richey

Riverview

Not sure which office is closest? Call us at 813-875-5445

Getting help from a Tampa insurance dispute attorney

An insurance dispute attorney from the law firm of KFB Law gives you access to trusted legal advice and skilled representation when your insurance company fails to abide by the terms of the policy it issues. You do not have to accept and live with an arbitrary decision from your insurance carrier. Our personal injury attorneys are committed to making insurance companies live up to the agreements they make with you.

Our insurance lawyers help client with everything from general insurance disputes such as disagreements with insurance companies following an accident. We can also help if a problem arises with your insurance company over payment of medical bills, property damage, or lost wages. If you have a case where you have found yourself in a dispute with an insurance company, regardless of the reason or the type of insurance coverage, we can help.

Florida Bar Certified

Need Immediate Help?

Questions can’t wait — and neither should you. Start a live chat or send us a text, and get answers fast from a real legal expert.

Free consultation — 24/7

Trusted for Decades

Rated 4.9/5

Related Blog & News Posts

Contact Us

We’re always ready to help. Reach out to our team anytime—day or night—for trusted legal support.

Get a free consultation — Lightning-fast replies 24/7.

“Every lawyer I went to told me I didn’t have a case at all and that there is nothing that they can do. KFB LAW works miracles and will never disappoint their clients. KFB LAW is the best. Call! Don’t hesitate at all. They are the best.”

Kings M

Car Accident

Your data is 100% confidential.